What to Know, Before You Go

You are leaving the McHenry Savings Bank website and going to a website operated by a third party not affiliated with McHenry Savings Bank. That site has a privacy policy and security practices different from that of the McHenry Savings Bank website. McHenry Savings Bank and its affiliates are not responsible for the content, policies or practices of third parties.

Click “OK” to continue or “Cancel” to go back

How do you manage your business and personal finances when the landscape shifts substantially? Do you have a strategy to recognize the new environment, or might you “miss the turn” and not make the necessary changes to be positioned to thrive in the new environment?

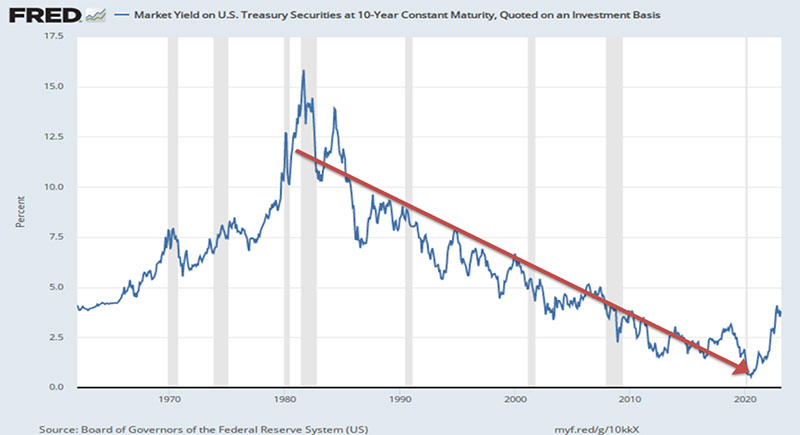

The Federal Reserve pumped money into the economy at unprecedented levels and in unprecedented ways over the last several years, accelerating the 40-year race to zero for interest rates in 2020 and 2021. For borrowers, this trend has been beneficial in lowering debt costs, raising asset values, and encouraging borrowing for business growth. While there have been many bumps along the way, the overall direction has been consistent since the early 1980s.

However, as they have had to accommodate ever-increasing levels of fiscal stimulus, first for the Great Recession and recently for the pandemic, the low rates have come at a cost of accelerating inflation and unsustainable activity levels across the economy. The Federal Reserve has rapidly increased short-term rates and started to shrink their holdings of debt, both of which are designed to moderate economic activity and cool inflation.

What is surprising to us is how many market pundits and business people are debating the duration of the Fed’s tightening push, under the apparent assumption that once inflation is controlled, rates will revert to the very low levels of 2021 and early 2022. To manage your finances well, you need to be asking which the anomaly is, 10-year rates near zero or closer to 6%? If it is the former, you should be taking steps now to prepare for the implications the higher rates will have on your cost structure over the long term.

Steps to take now

1. Project your cost of debt over each of the next 5 years if your term borrowing costs were to become 8% or more. It is wonderful if you were able to borrow for your land or equipment over the last couple of years at the low rates that were available, but if that debt matures within the next few years, what will that do to your cost structure?

2. Get your borrowing house in order. What can you do to make sure you have the maximum flexibility to finance when rates are attractive and not be forced to borrow when they are not? Prepare for impending debt maturities or re-pricings a couple of years before they occur.

3. If possible, begin setting aside funds invested in liquid short-term accounts paying more than your existing loan rates. These funds can then be used to either subsidize the roll-over loan rate when renewal comes, or can pay down the principal at that time, thereby mitigating the effect of the higher rate on the debt.

4. Make plans for maximum offense and maximum defense. Between the Fed’s fight against inflation and a variety of geopolitical risk factors, the one thing we can say with confidence is that the conditions of today are unlikely to persist. Should the Fed over-tighten and create a deep recession, or if a major geo-political event were to occur, rates might plummet again. Or if the inflationary pressures continue to build, perhaps due to the extraordinary labor market conditions, rates may rise well above current levels. Have you thought through how you would react in either scenario? Are you in a position, either because of cash balances or borrowing capacity, to be able to move quickly?

In general, it can be useful to think through several different but rather extreme scenarios and their potential impact on your finances. While none of the scenarios you identify may occur, preparing for them as if they might put you in the best position to react as you see actual events unfold in one direction or another. The status quo is unlikely to remain stable - don’t make plans as if it will.

A good lender should be able to listen intently to your objectives and help you select the loan terms that best permit you to take advantage of today’s rates and structural alternatives. While many banks may not be able to offer the full range of long-term fixed rates currently available, McHenry Savings Bank, through its relationships with FarmerMac and other leading farm lenders, can provide a full menu of attractive financing alternatives. Please feel free to contact us to discuss your situation or address any questions you may have.

Authors

Don Wilson, Chairman, President & CEO

Tim Kempel, SVP - Agribusiness Banking, NMLS# 586675

tkempel@mchenrysavings.com or (815) 331-6406

McHenry Savings Bank, NMLS# 630527